China stimulus review

Author: Chen Senyi (Research Executive)

Editors: Singaravelan Divyashree (Research Director), Goh Jing En (Vice President (Research & Publicity))

Overview of China’s economy

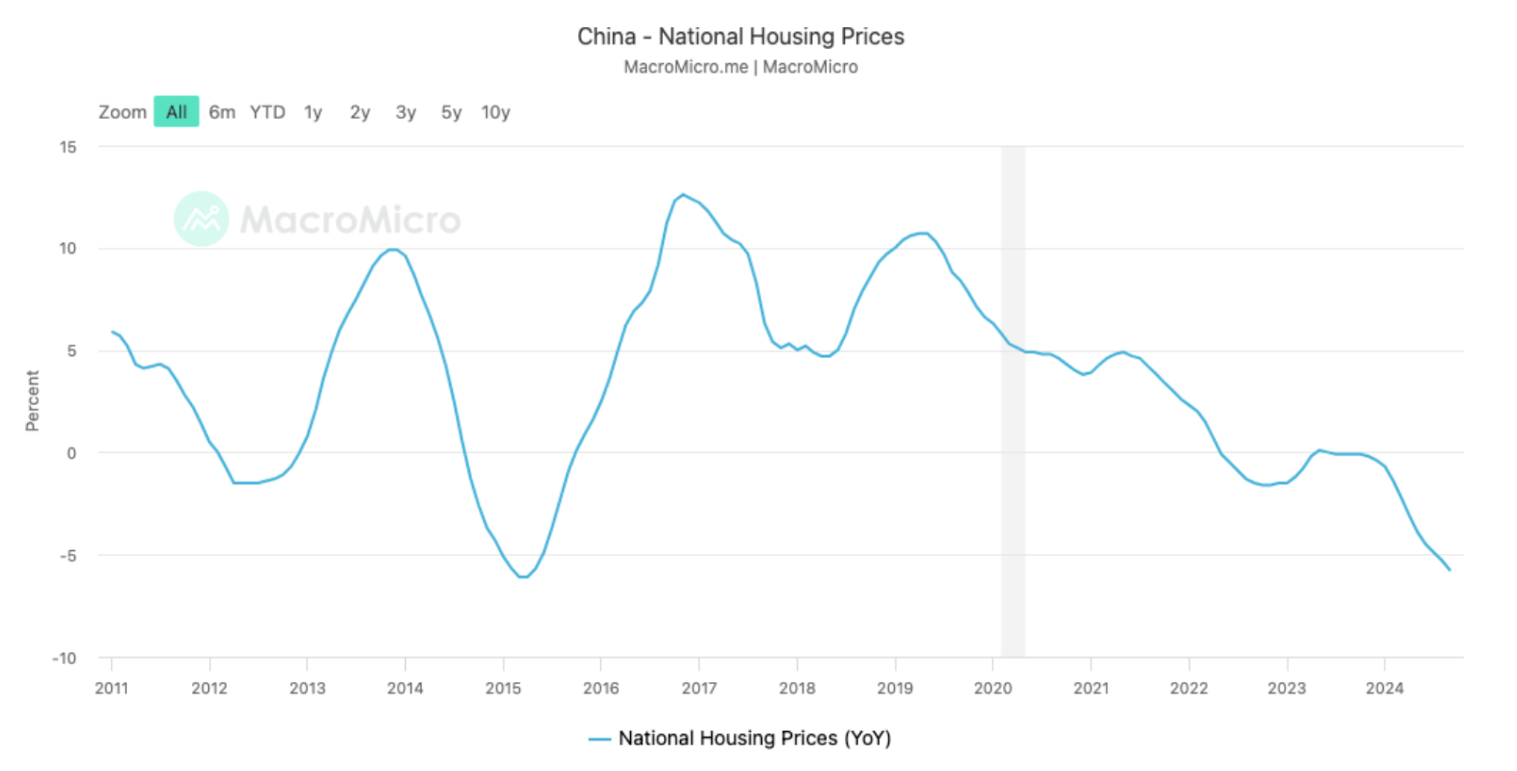

In recent years, China’s economy has faced substantial challenges, primarily driven by persistent issues in the property market. For many Chinese citizens, housing is more than a basic necessity—it represents a core investment and a significant portion of personal wealth. Thus, as property values have sharply declined, a pronounced negative wealth effect has emerged, eroding consumer confidence and slowing economic growth.

The drop in housing demand has also strained real estate developers, tightening their cash flows and reducing their ability to refinance. This contraction has further led to falling land values and decreased land sale revenues, which are vital sources of funding for local governments. Consequently, local authorities—heavily reliant on revenue from land-use transfers—are now struggling to meet their debt obligations. As refinancing challenges deepen, urban investment bonds have seen deteriorating credit ratings and solvency, exposing local governments to a latent debt crisis.

Source: National Bureau of Statistics of China, Trading Economics

Source: China Ministry of Finance, MacroMicro

Strengthening resolve to solve the crisis

China’s renewed resolve to address its economic challenges began with an initiative from Pan Gongsheng, Governor of the People’s Bank of China, who introduced a cut to the Required Reserve Ratio (RRR) to encourage greater bank lending. He also proposed a swap facility to tap central bank funds for equity purchases, leading to a sharp rally in the Shanghai, Shenzhen, and Hang Seng indices—a visual sign that confidence in these policies has, at least temporarily, been bolstered.

However, these policy effects will take time to materialise, and many economists still anticipate a slowdown in China’s economy, with doubts that the 5% growth target for this year will be achieved. Notably, the central government has held back from implementing a more robust fiscal stimulus to drive domestic consumption, opting instead for a cautious approach. This restraint suggests a preference to avoid direct cash handouts, allowing the economy to recover more gradually and sustainably.

Source: Bloomberg (updated as of 30th September)

Outlook

I am optimistic that the recent rounds of stimulus will indeed temporarily strengthen consumer confidence. By channelling resources into advanced industries to build competitive advantages, China is aligning with its long-term national interests of achieving technological superiority and self-reliance. However, if additional fiscal stimulus is introduced, it should be carefully allocated. Such funds should avoid sectors plagued by overcapacity or those prone to unsustainable growth through short-lived, unproductive projects. Instead, fiscal stimulus should be strategically invested, focusing on productivity-enhancing industrial policies and small, targeted cash distributions through the Central Bank Digital Yuan initiative.

Looking ahead, it’s evident that China will need to prioritise technological self-sufficiency, especially in light of intensifying geopolitical tensions and technological barricades. Ensuring robust domestic consumption has become increasingly urgent as well, as it would provide economic resilience against trade pressures during President Trump’s second term in office. Therefore, building a more self-sustaining economic model would better insulate China from external uncertainties and ensure stable growth amid unpredictable global shifts.

References

Bloomberg News. (2024, September 27). China’s stimulus blitz: What we know so far and what to expect. Bloomberg.

China’s Stimulus Blitz: What We Know So Far and What to Expect - Bloomberg

MacroMicro. China house price YoY.

National Housing Prices | China Real Estate | Collection | MacroMicro

MacroMicro. China local government state-owned land sales revenue. Local Government Revenue from State-Owned Land Use Right Transfer | China Real Estate | Collection | MacroMicro

Trading Economics. China consumer confidence.

https://tradingeconomics.com/china/consumer-confidence